Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting. By stating that one of Companys.

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

If the first tax basis period is changed to 1 Jan 2019 to 31 Jan 2020 you are paying only 17 for the chargeable income RM600000 and below.

. Discuss this and choose the assessment that requires you to pay the least income tax generally separate assessments bring. Please be reminded to keep good tax records for future tax audit conducted by Inland Revenue Board Malaysia IRBM. Why It Matters In Paying Taxes Doing Business World Bank Group.

Take care of your health. Contract payment for services done in Malaysia. The highest tax rate of a company or limited liability partnership LLP is 24 if your individual income tax rate is higher than 24 it will be more tax efficient to tax the business income under CompanyLLPOn the other hand if your individual tax rate is lower than 24 you may want to swift the business income to.

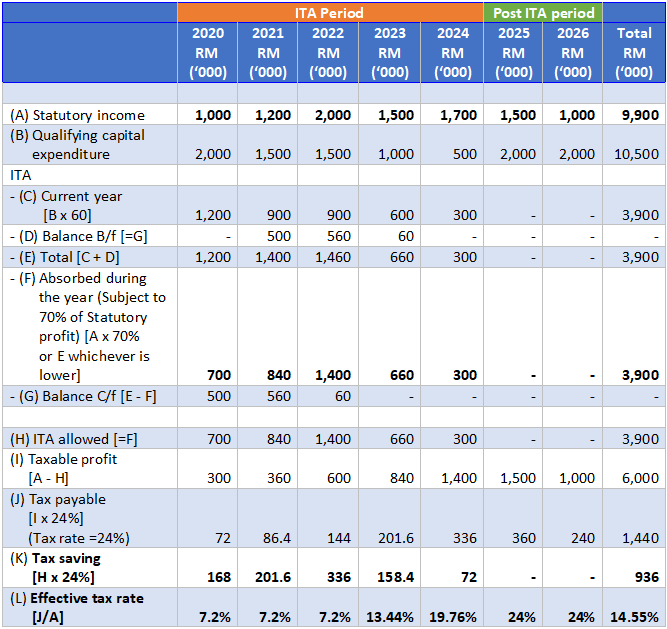

There are various tax incentives offered by the government which could further reduce a companys tax liability. Taxes need to be submitted and paid on time. Take care of your parents.

Corporate income tax rebate of 25 percent of tax payable capped at SGD 15000. Section 80EE allows you to deduct up to Rs 50000. Pay taxes in.

For corporations the tax rate is 19 percent for the first 500000 MYR and 24 percent for any amount exceeding this threshold. Sports equipment and gym membership fees. The company tax rate for businesses with less than 50 million turnover is 275 if 80 or less of a companys assessable income is passive income such as interest dividends rent royalties and net capital gains.

The maximum income tax relief amount for the lifestyle category is RM2500. A new company must pay this tax from the 6th month of the basis period. Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019.

You can claim your expenses to set-off against the employment income received from your employer and thus reduce the personal tax payable to LHDN. Reduction in company tax rates for small business. Compare tax payable between separate assessment and joint assessment.

Covid 19 The Enhanced Wage Subsidy Programme Bdo. Special classes of income. Whether you benefit from a company car depends on the value of the car and your current tax bracket.

How Can A Company Reduce Tax Payable In Malaysia. 10000 if you purchase medical insurance. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system.

The Income Tax Act 1967 provides incentives in categories such as. Meanwhile for those earning above RM1 million the tax rate was increased from 25 to 28. The State Of The Nation Should Epf Tax Relief Be Reduced Next Year The Edge Markets.

2 Submit and pay income tax on time. For individuals the rate is from 0 to 26 percent depending on the amount of income earned. Tax offsets also known as tax rebates can reduce your taxable income if you meet certain eligibility requirements.

When the tax payable for a particular year of assessment exceeds the original or the revised estimate if a revision is submitted by an amount exceeding 30 of the tax payable the difference will be subject to a penalty of 10. If you are receiving travelling or entertainment allowances from your company you dont need to report it to income tax department LHDN. This means that the more income you earn the higher amount of taxes you have to pay.

A Medical expenses for your parents. Following the Budget 2020 announcement in October 2019 the reduced rate. There are also tax reliefs that youre entitled to when it comes to parental care.

Technical fees payment for services or payment for use of moveable property. Under Sec 80C you can reduce your taxable income by investing Rs 15 lakh. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million.

If you use a Trust structure one strategy is to allocate profits. Corporate tax rates in malaysia most companies which are tax residents in malaysia are taxed on an annual basis at a rate of. When it comes to paying the estimated tax every corporate company should pay such tax through CP207 on or before the 10 th of every month.

The amount of tax saving is RM7000. Reduce Your Tax Rate. You can deduct up to Rs.

If your spouse is working and is also paying tax you may want to compare your income tax payable under separate assessments or a joint assessment. It is important to determine the tax status of a company as there are differences in the income tax rate chargeable to the companies. If the first tax basis period is 1 Jan 2019 to 31 December 2019 you are paying 17 for chargeable income RM500000 or below.

Franking credits can reduce the income tax paid on dividends or potentially be received as a tax refund. So if you bought a computer that costs more than that you can no longer include your gym. If the employer pays for fuel the tax payer is taxed an additional RM 1200 for this BIK.

They cared for you when you were growing up and nows your chance to take care of them in their old age. Malaysia uses a progressive tax scheme. Books journals magazines printed newspapers.

You can reduce your taxable income by taking advantage of all tax deductions. Tips For Income Tax Saving L Co Chartered Accountants. During colonial rule the British introduced taxation to the Federation of Malaya as it was then known with the Income Tax Ordinance 1947.

According to the Public ruling for BIK s the tax payer must pay RM 3600 in taxes every year for a car worth RM 75000. In Budget 2016 the tax rate for those earning an income between RM600000 and RM 1 million was increased from 25 to 26 for year of assessment 2016. Final Tax payable.

Accelerated tax depreciation for plant and machinery over two years and over one year for expenditures on renovation and refurbishment. The current CIT rates are provided in the following table. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

If both husband and wife are high-income earners filing for separate assessment is an obvious and easy. Interest paid by approved financial institutions. On the other hand already existing companies must file the estimated tax payable 30 days before the starting of a new year.

The ordinance was repealed by the Income Tax Act 1967 which took effect on 1 January 1968. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. Computer annually payment of a monthly bill for internet subscription.

Go for a holiday.

Corporate Tax Planning In Malaysia Tax Options Tax Position

Updated Guide On Donations And Gifts Tax Deductions

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tips For Income Tax Saving L Co Chartered Accountants

Malaysian Tax Issues For Expats Activpayroll

Income Tax For Sole Proprietors Partnership In Malaysia 2020 Updated

Malaysian Bonus Tax Calculations Mypf My

7 Tips To File Malaysian Income Tax For Beginners

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Tax Rebate For Set Up Of New Businesses L Co

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Cukai Pendapatan How To File Income Tax In Malaysia

Tips For Income Tax Saving L Co Chartered Accountants

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Special Tax Deduction On Rental Reduction